- #Neuroshell 2 tradestation add on how to#

- #Neuroshell 2 tradestation add on manual#

- #Neuroshell 2 tradestation add on download#

#Neuroshell 2 tradestation add on how to#

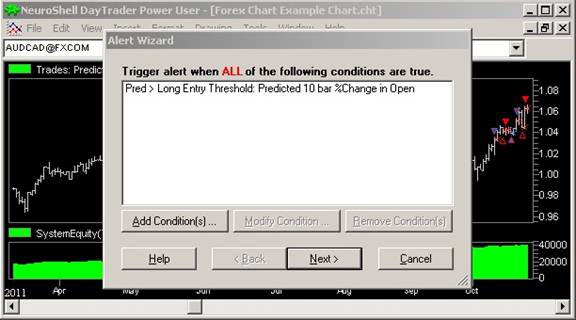

We are often asked about more advanced training on how to use NeuroShell Trader, so we decided to offer a past webinar to our customers. based email customer service and technical support Optimize and back test multiple trading strategy templates on multiple instruments in one continuous process Market optimization, data exporting, dynamic link library indicators, custom data feeds andĬustom brokerage interfaces are all at your fingertipsĬombine different timeframes of data, indicators, predictions, and trading strategies into one chart or analysisġ5 position sizing methods control how much to buy with each trade or let the optimizer decide the mostĬhoose to enter or exit trades with more than one order or let the optimizer decide the most profitable entryĮvaluate performance on systems that re-optimized regularly on newer data, and then applied to out-of-sample Hybrid models, panels of experts, pairs trading, portfolio models, market neutral hedging, Min & max avg trade span restrictions, max number of inputs control, optimization time restriction. Optimize across all chart pages, objective functions, alogrithm selection (2 genetic options, swarm and brute force),

#Neuroshell 2 tradestation add on manual#

Visual and sound notification of important eventsĪutomatically send your models trades to your favorite brokerage while you’re out on theĬommisions, margin, slippage, exchange rates, time range restrictions, dollar & account balance position sizing, round lot trading option,Īnd manual prediction adjustments for trading position, threshold & hidden layer. Lightning fast optimization of complex models with distributed processing across multiple Large library of technical analysis and trading system indicatorsįind patterns in your data to predict future values or other data streamsĮasy to build rule based trading models, advanced neural network predictive trading modelsįaster optimization of predictions, trading rules and indicatorsĪbility to create and save custom indicatorsĪbility to purchase and use add-on indicators from Ward Systems Group and other 3rd party providers.īuild models which react quickly to market moves by including other market indexes, data andĭetermine if a model will hold up in the future before you risk real money trading it Quickly develop and test trading systems in a charting interface

SetDefaultBarFgColor(Color.RGB(0x00,0x94,0xFF), 0) įpArray = new FunctionParameter("ShortLength", FunctionParameter.NUMBER) įpArray = new FunctionParameter("DominantCycle", FunctionParameter.Easily create complex neural networks, trading systems and indicators with no programming SetStudyTitle("Moving Average Difference - Hann Indicator") The related article is copyrighted material. reserves the right to modify and overwrite this EFS file with each new release. In the United States and/or other countries. All Rights Reserved.ĮSignal is a service mark and/or a registered service mark of Intercontinental Exchange, Inc. The eSignal formula script (EFS) is also available for copying & pasting below.Ĭopyright 2019 Intercontinental Exchange, Inc.

#Neuroshell 2 tradestation add on download#

To discuss this study or download a complete copy of the formula code, please visit the EFS library discussion board forum under the forums link from the support menu at or visit our EFS KnowledgeBase at. Here is an example of the study plotted on a daily chart of SPY. If Filt2 0 then MADH = 100*(Filt1 - Filt2) / Filt2 įIGURE 3: eSIGNAL. LongLength = IntPortion(ShortLength + DominantCycle / 2) įilt1 = Filt1 + (1 - Cosine(360*count / (ShortLength +Ĭoef = coef + (1 - Cosine(360*count / (ShortLength + 1))) įilt2 = Filt2 + (1 - Cosine(360*count / (LongLength +Ĭoef = coef + (1 - Cosine(360*count / (LongLength + 1))) MADH (Moving Average Difference - Hann) Indicator Ehlers explains that excellent buy and sell indications can be seen in the indicator’s valleys and peaks, respectively.

The enhancement comes from the utilization of the Hann windowing technique and takes the difference of two finite impulse response filters. While the MAD is said to offer an improvement over the classic, well-known MACD, the MADH (moving average difference with Hann) that Ehlers presents in his article in this issue, “The MADH: The MAD Indicator, Enhanced,” is said to offer an improvement over the MAD indicator. The MAD indicator effectively took the difference between two simple moving averages. Last month in his October 2021 article in S&C, “Cycle/Trend Analytics And The MAD Indicator,” John Ehlers presented the MAD (moving average difference) indicator, an oscillator developed out of his research into understanding cycles data better.

0 kommentar(er)

0 kommentar(er)